Hiring new employees means a lot of paperwork — for you and for them. Among the new hire forms, one you can’t overlook is the required IRS employment tax form W-4.

In a rush to get through it all, you may be tempted to streamline the process by helping employees with the form — or even completing it altogether. But beware. You can’t overstep the boundaries between complying with IRS requirements and providing W-4 advice — especially regarding exemptions from withholding.

So where do you draw the line?

Inform but don’t advise on employee withholding

As a small business owner, you have a responsibility to collect and pay employment taxes to the IRS. But employees have an equal responsibility to ensure their tax-related information is correct. That includes providing accurate withholding information on the W-4.

AN EMPLOYEE FILLING OUT A W-4 FORM ALLOWS HIM/HER TO CLAIM ALLOWANCES FOR THINGS SUCH AS:

- Dependents

- Tax credits

- Filing as head of household

Each allowance reduces the amount you withhold from an employee’s paycheck.

If an employee comes to you with questions (which he/she most likely will), keep in mind the limits. You can assist the employee, but completing a W-4 altogether is illegal. Also, employees must fill out and sign their own W-4 forms.

An employee must sign and date the W-4, or it will be invalid.

Remember: You can help a new hire by explaining the W-4 form and providing information about the choices, but you should not influence the worker’s responses. The employee is ultimately responsible for the allowances he/she claims.

Although you can’t influence how an employee completes the W-4, you can respond to the following questions as follows:

1. “Can I choose complete tax exemption?”

You must meet specific IRS criteria to claim tax exemption. In general, this means you can be claimed as a dependent by another taxpayer and you received a full refund last year (or expect to receive a full refund this year) due to no tax liability.

2. “How do allowances work?”

Basically, the fewer allowances you claim, the more federal income tax withheld from your paycheck. In turn, the higher the number of allowances, the less federal income tax withheld.

3. “Can I change my W-4?”

Yes. You can update your W-4 forms for a variety of personal or financial reasons, such as marriage, divorce, a change in dependents or a significant salary increase. Unlike with health insurance with open enrollment restrictions, you can change your W-4 as often as you’d like throughout the year.

Tackle incomplete or missing W-4 forms

What should you do if the employee doesn’t complete or sign the W-4 in a timely manner? Ideally, you would not have a new employee start work until you receive a completed W-4. If an employee delays completing a W-4 for some reason, you should withhold taxes as though the employee is single with no allowances.

The IRS no longer requires employers to send copies of questionable W-4 forms (such as those claiming more than 10 allowances). Furthermore, it’s not your responsibility to verify the accuracy of any information an employee provides on the W-4.

If a payroll cycle passes and the employee has ignored your requests for a completed W-4, you may consider taking action. That might include suspending the employee until you receive the completed form. Consult a legal advisor for suggestions on how to best address the problem.

Compliance Tip:

Have new employees complete the W-4 before their first day of work. You won’t have to worry about chasing the form down later.

Simplify the process

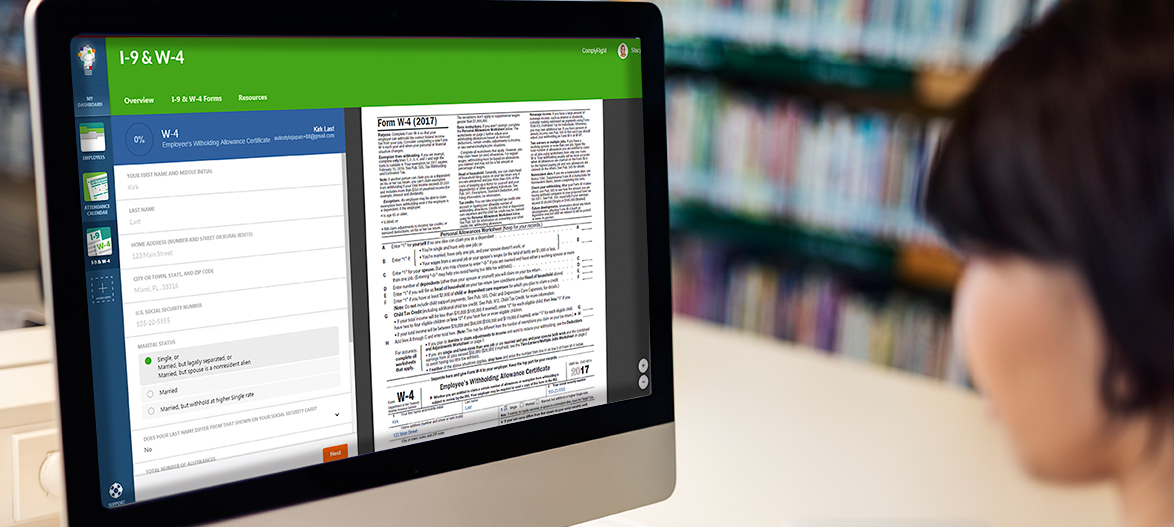

You can simplify the entire process of getting W-4s from new employees, as well as managing updates when employees have changes to report, with a dedicated

I-9 & W-4 app. This online tool makes it easy for employees to complete their W-4s independently and in a timely manner.

KEY TAKEAWAYS

- Filling out W-4 forms for your employees is not legally permitted

- Ensure employees sign their own W-4 forms

- Offer instructions but not advice

- The employee is responsible for supplying the information on the W-4 form

- Have the employee update the W-4 whenever his or her status or income changes. Employees can request to update their W-4s at any time.

Free E-Book

Who Has Time to Manage HR? You Do!

Here's How to Handle It Like A Pro

Learn How